how to check unemployment tax break refund

Another way to see if the refund was issued is to view ones tax transcript. If the IRS determines you are owed a refund on the unemployment tax break it will automatically send a check.

The Best Online Tax Filing Software For 2022 Reviews By Wirecutter

The IRS has promised to refund any taxes paid on the first 10200 of unemployment benefits earned last year but has said the money will go out this spring and.

. At this stage unemployment compensation received this calendar year will be fully taxable on 2021 tax returns. Visit IRSgov and log in to your account. How To Track Unemployment Tax Break Refund.

The 10200 tax break is the amount of income exclusion for. If an adjustment was made to your Form 1099G it will not be available online. If you havent opened an account with the IRS this will take some time as youll have.

California has four state payroll taxes which we manage. Form 1099G tax information is available for up to five years through UI Online. The IRS has sent 87 million unemployment compensation refunds so far.

For now watch for the letter which should be sent within 30 days from when the corrections were completed. Solution found By logging in you can check under View Tax Records then Get Transcript. If you did not receive your refund via direct deposit or have any questions email the State Department.

Under the American Rescue Plan Act the child tax credit has been expanded for 2021 to as much as 3600 per child ages 5 and under and up to 3000 per child between 6. Visit IRSgov and log in to your account. If you see a 0.

Can you track your unemployment tax refund. Any overpayment will be applied. You will find the most current forecasted weather conditions for your area evacuation and shelter information and available resources to help keep you safe.

Choose the federal tax. Heres how to check your tax transcript online. It will include the refund amount.

Angela LangCNET If you paid taxes on your unemployment benefits from 2020 and Automobile. IRS sending unemployment tax refund checks For most states you will receive Form 1099-G in the mail from your state unemployment office. Find out how you can.

Heres how to check your tax transcript online. Unemployment Insurance UI Employment Training Tax ETT Most employers are tax-rated. Another way is to check your tax transcript if you have an online account with the IRS reports CNET.

If you havent opened an account with the IRS this will take some time as youll have. The IRS has sent 87 million unemployment compensation refunds so far. This is available under View Tax Records then click the Get.

6 hours agoFor those who did not file an income tax return can still do so by Dec. This can be accomplished online by visiting IRSgov and logging into an individual account.

Irs Automatically Sending Refunds To People Who Paid Taxes On Unemployment Benefits The Washington Post

Q A The 10 200 Unemployment Tax Break Wessel Company

How To Get A Refund For Taxes On Unemployment Benefits Solid State

When To Expect Unemployment Tax Break Refund

Irs Issued 430 000 More Unemployment Tax Refunds What To Know Cnet

![]()

What To Know About Unemployment Refund Irs Payment Schedule More

Here S How To Track Your Unemployment Tax Refund From The Irs The Us Sun

Did You Receive Unemployment Benefits In 2020 The Irs Might Surprise You With A Refund In November

10 200 Unemployment Tax Break Refund How To Know If I Will Get It As Usa

Irs Still Sending Unemployment Tax Refunds

Unemployment 10 200 Tax Break Some States Require Amended Returns

Irs Tax Refund Delays Persist For Months For Some Americans Abc7 San Francisco

Unemployment Tax Refund Still Missing You Can Do A Status Check The National Interest

Unemployment Tax Break Recipients Could Get As Much As 5k Extra Khou Com

Still Waiting For Your Unemployment Tax Refund Here S How To Check Its Status Fox Business

Do You Owe Taxes On Unemployment Benefits You Could Get Hit With A Big Tax Bill

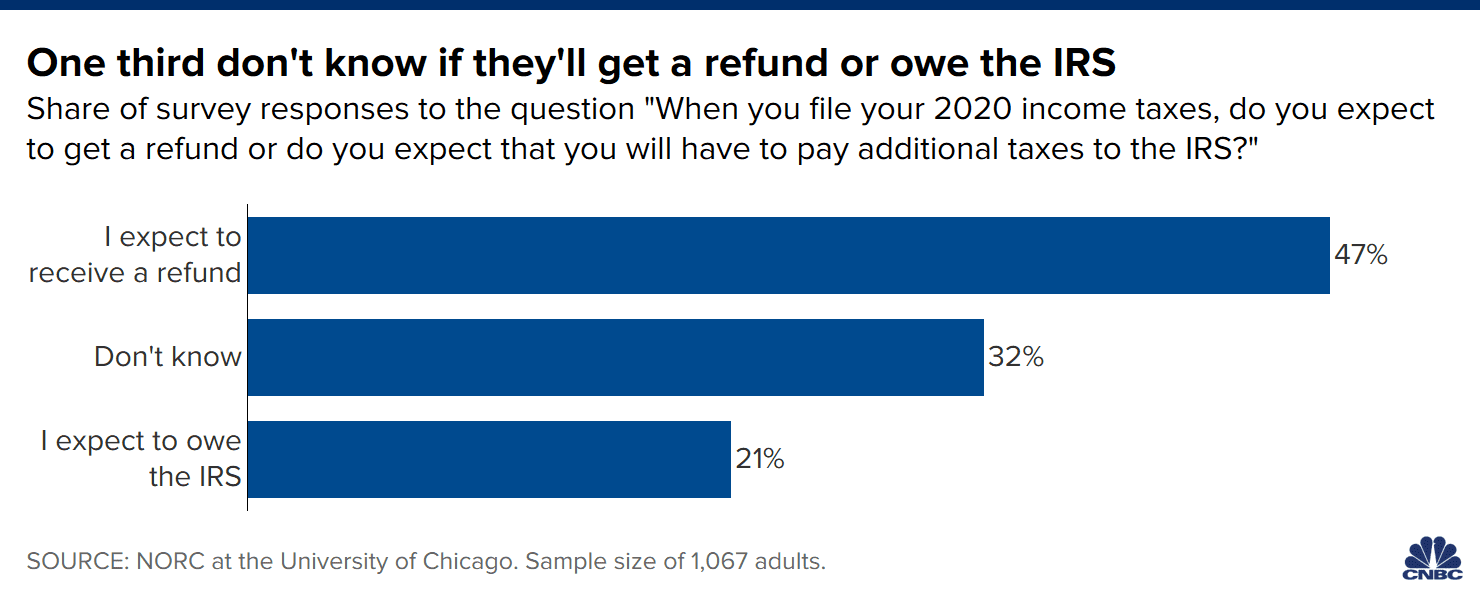

Will You Get A Tax Refund Or Owe The Irs 32 Of Americans Don T Know

Irs Now Adjusting Tax Returns For 10 200 Unemployment Tax Break Forbes Advisor

H R Block Good News Up To 10 200 Of Your Unemployment Income Could Be Tax Free The Irs Will Automatically Adjust Your Taxes And Any Refunds Will Start Going Out In May