self employment tax deferral due date

Filing on time avoids delays and ensures that the self-employed individual spouse or common law partner receive the refunds benefits or credit payments that they may be entitled to in a timely manner. The owner can contribute both.

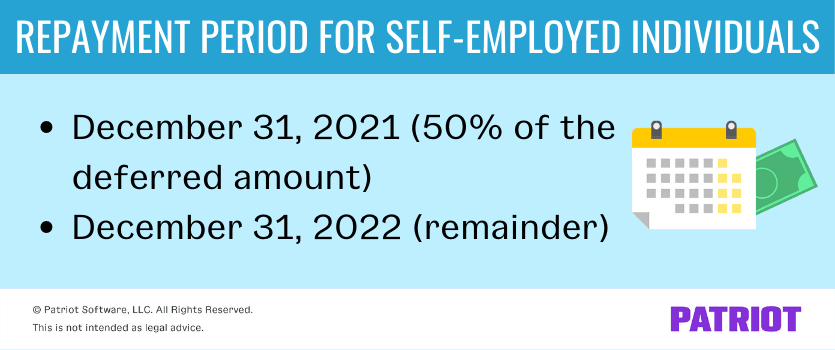

Self Employed Social Security Tax Deferral Repayment Info

This was a one-time deferral.

. Discover Helpful Information and Resources on Taxes From AARP. 17 2021 Certain self-employed taxpayers who took advantage of COVID-19 relief measures for Social Security taxes during 2020 must repay half of the deferred amount by the end of this year or face interest charges and penalties. Legislation allowed for self-employed individuals to defer the payment of certain social security taxes for 2020 over the next 2 years.

Self-Employed Tax Deferral Payments Due Dec. Keep Every Dollar You Deserve When You File Business Taxes w TurboTax Self-Employed. Employer nonelective contributions up to.

Self-employed individuals may defer the payment of 50 percent of the Social Security tax imposed under section 1401 a of the Internal Revenue Code on net earnings from self-employment income for the period beginning on. How to report self-employment tax that was deferred in 2020 That section of the program is not fully functional right now but since you have until 12312022 to make the second 12 payment I doubt there will be a line on the tax return. Self-employed individuals and their cohabiting spouse or common law partner Deadlines.

50 of the amount owed will be due on December 31 2021 and the remaining amount will be due on December 31 2022. 50 of the amount deferred is due by December 31 2021 and the remaining 50 is due by December 31 2022. Social Security tax deferral.

25 of compensation as defined by the plan or. Self-employed tax payments deferred in 2020. Self-employed taxpayers can also postpone the payment of 50 of the Social Security portion of their self-employment tax for the same period.

Discover Important Information About Managing Your Taxes. 31 In the News Legislation Tax Dec. Most affected employers and self-employed individuals received reminder billing notices from the IRS.

Ad We Simplify The Process And Keep It Industry-Specific So You Can File Taxes w Confidence. Filing date for 2020 tax year. The employer should send repayments to the IRS as they collect them.

Half of the deferred Social Security tax is due by the end of this year 2021. The remaining half of the deferred tax is due January 3 2023. The IRS in News Release IR-2021-256 reminded taxpayers who deferred paying employer FICA for a portion of 2020 or a portion of their 2020 self-employment tax that a deadline is approaching on January 3 to pay a portion of the deferred taxes.

Ad Are You Suddenly Self-Employed. This means self-employed workers could defer 62 in Social Security tax of their taxable income 50 of their 124 Social Security tax responsibility during the deferment period. The CARES Act allowed self-employed individuals and household employers to defer the payment of some of their Social Security taxes on their 2020 tax returns.

Repayment of the employees portion of the deferral started January 1 2021 and will continue through December 31 2021. September 10 2021. Heres how to pay the deferred self-employment tax.

Use the link in the other answer to make the first second payments whenever you wish up to the due dates. Elective deferrals up to 100 of compensation earned income in the case of a self-employed individual up to the annual contribution limit. The due dates per the CARES act are December 31 2021 and 2022 but since both fall on weekends the actual due dates are on the following Mondays Also self-employed individuals were able to defer payment of one half of their 2020 Self-Employment Tax incurred from March 27 to.

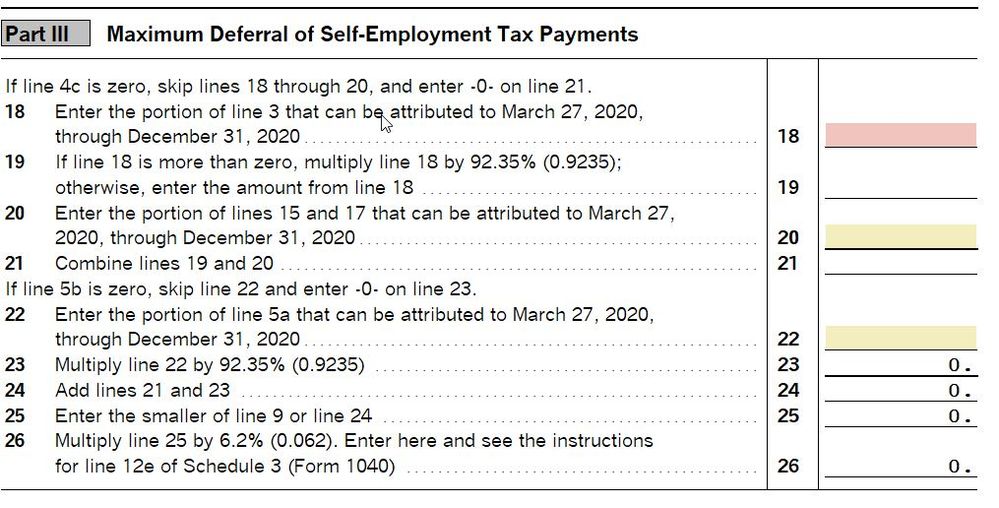

This means that self-employed individuals that defer payment of 50 percent of Social Security tax on their net earnings from self-employment attributable to the period beginning on March 27 2020 and ending on December 31 2020 may reduce their estimated tax payments by 50 percent of the Social Security tax due for that period. The CARES Act allowed eligible employers and self-employed individuals to delay the deposit of the employers share of Social Security taxes for the period beginning on March 27 2020 and ending before January 1 2021. 1 The release explains the option provided to qualifie.

19500 in 2020 and 2021 or 26000 in 2020 and 2021 if age 50 or over. The IRS recently announced how to pay these taxes. The Coronavirus Aid Relief and Economic Security CARES Act allowed those who are self-employed as well as household employers to defer the payment of certain Social Security taxes on their Form 1040 2020 tax year over the next two years.

Payments made by January 3 2022 will be timely because December 31 2021 is a holiday. WASHINGTON The Internal Revenue Service today reminded employers and self-employed individuals that chose to defer paying part of their 2020 Social Security tax obligation that a payment is due on January 3 2022. Half of the deferred Social Security tax is due by December 31 2021 and the remainder is due by December 31 2022.

The Coronavirus Aid Relief and Economic Security Act allowed self-employed individuals and household employers to defer the payment of certain Social Security taxes on their Form 1040 for tax year 2020 over the next two years. Half of the deferred amount is due by 123121 and the other half is due by 123122. According to the IRS self-employed individuals may defer the payment of 50 percent of the Social Security tax imposed under section 1401a of the Internal Revenue Code on net earnings from self-employment income for the period beginning on March 27 2020 and ending December 31 2020 However the deferred payments must still be made by the dates applicable to all.

If you have employees you can defer the 62 employer portion of Social Security tax for March 27 2020 through December 31 2020. If youre self-employed and you took advantage of the 2020 Social Security tax deferral the due date for your first payment is Dec. The self-employment will follow the same due dates as the employers share of Social Security tax deferment.

Thanks to passed legislation self-employed individuals were allowed to defer 50 of their Social Security tax portion of self-employment tax from March 27 2020 December 31 2020. SeeHow self-employed individuals and household employers repay deferred Social Security tax for information about due dates and payment options.

Can I Still Get A Self Employment Tax Deferral Shared Economy Tax

Deferral Of Se Tax Intuit Accountants Community

Tax Deferral From 2020 Time To Pay Up Barbara Weltman

Deferred Social Security Tax Payments Due Today For Employers Self Employed Njbia New Jersey Business Industry Association

What The Self Employed Tax Deferral Means Taxact Blog

What The Self Employed Tax Deferral Means For Your Self Employed Tax Clients Taxslayer Pro S Blog For Professional Tax Preparers

How To Defer Social Security Tax Covid 19 Bench Accounting

Request Deferral Of Interest Payment Template By Business In A Box Statement Template Lettering Letter Sample

Deferral Credit For Certain Schedule Se Files Intuit Accountants Community