closed end loan examples

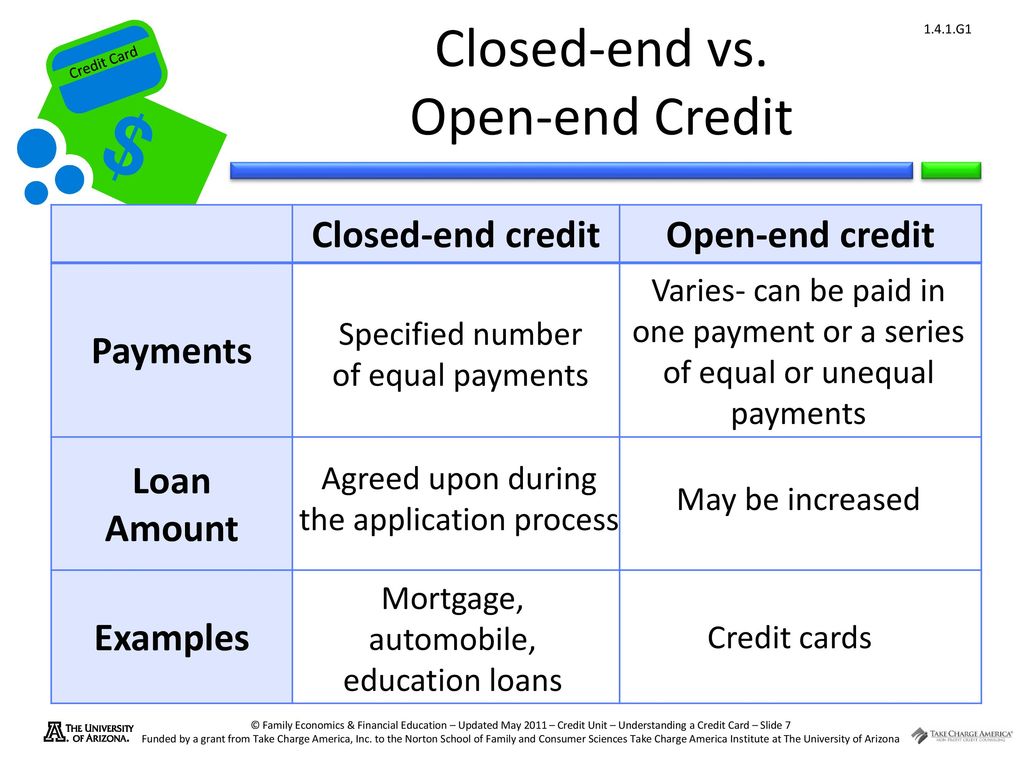

A closed-end loan is to be contrasted with an open-ended loan where the debtor borrows multiple times without a specified repayment date like with a credit card. The credit line remains available for your use.

What Is Closed End Credit Cash 1 Blog News

Credit cards and a home equity line of credit or.

. Both loan types allow you to borrow a set. A repayment example may also be stated as a unit cost. No Closed-End Second Mortgage Loan or HELOC has a Combined Loan-to-Value Ratio at origination in excess of 100.

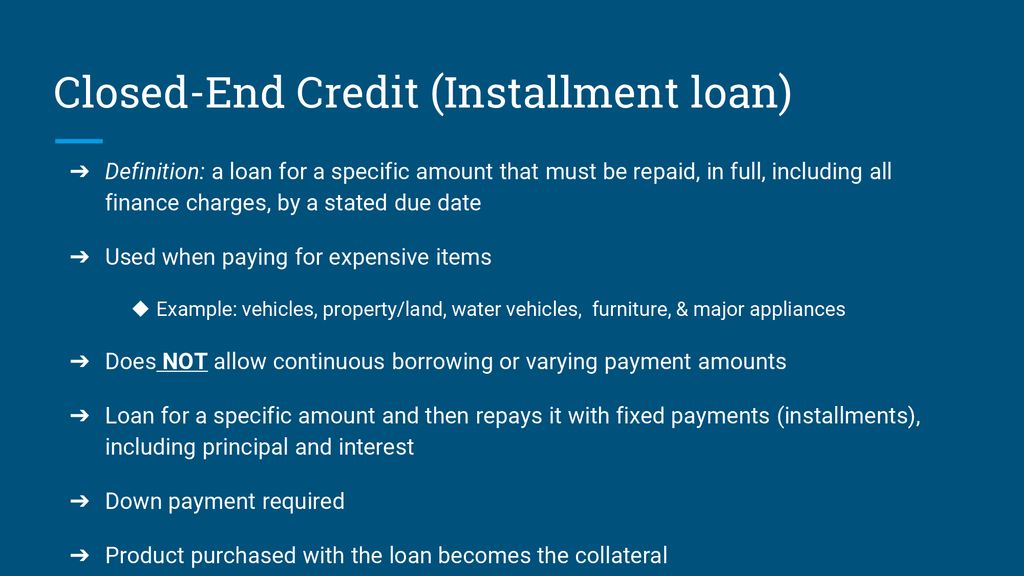

A closed-end loan is one in which the borrower receives a sum of money that they must repay by a certain date often in monthly installments. If the credit card agreement does not require. As mentioned earlier personal loans auto loans mortgages and student loans are examples of closed-end credit.

What are three examples of closed ended loans. Payday loans are also an example of closed-end consumer. For a 25000 auto loan for a term of 60 months with a 275 APR the monthly payment will be ______.

A credit card is another great example of an open end loan this time it can be either secured or an open-end unsecured loan. Personal loans both secured and unsecured are an appealing option for people who have credit card debt and want to lower their interest rates by transferring balances. Examples of closed-end loans.

A closed-end home equity loan is similar to a traditional home mortgage. Definition and Examples of a Closed-End Home Equity Loan. Mortgage loans and automobile loans are examples of closed-end credit.

Examples of closed-end loans include a home mortgage loan a car loan or a loan for appliances. An agreement or contract lists the repayment terms such as the number of. Sometimes referred to as revolving credit lines credit cards and home equity lines of.

Payments are usually of equal amounts. As mentioned before auto loans and real estate are examples of closed-end credit. Auto loans and boat loans are common examples of closed-end loans.

Are you allowed to borrow. A closed-end loan is a type of loan in which a fixed amount is borrowed and then paid back over a specified period. H-14 Variable-Rate Mortgage Sample 102619b H-15 Closed.

H-11 Installment Loan Sample. After you have paid off that amount you will be able to use the line of credit again. H-13 Closed-End Transaction With Demand Feature Sample.

Home mortgages and car loans. Closed-end loans are probably what you think of when you imagine a traditional loan. Examples of Closed-End Second Mortgage Loan in a sentence.

Auto loans student loans and mortgages.

How Home Construction Loans Work Lendingtree

What Is A Loan Types Of Loans Advantages Disadvantages Video Lesson Transcript Study Com

Ultimate Guide To Your Mortgage Closing Disclosure Forbes Advisor

:max_bytes(150000):strip_icc()/dotdash-what-difference-between-loan-and-line-credit-v2-c8a910fad66a476db1a4c013517eefbb.jpg)

Loan Vs Line Of Credit What S The Difference

Section Ppt Video Online Download

What Is Open End Credit Experian

Fin 202 Module 3 Homework Assignment Aiu Online

Finance Chapter 5 Flashcards Quizlet

:max_bytes(150000):strip_icc():gifv()/closed-endfund-6df9e83b48e548879987f06bb83a9020.png)

How A Closed End Fund Works And Differs From An Open End Fund

What Is A Loan Types Of Loans Advantages Disadvantages Video Lesson Transcript Study Com

What Are Interest Rates How Does Interest Work Credit Org

Credit Basics Advanced Level Pdf Free Download

Understanding A Credit Card Ppt Download

Loans Credit Personal Credit Loan Options

Lesson 16 2 Types Sources Of Credit Ppt Download

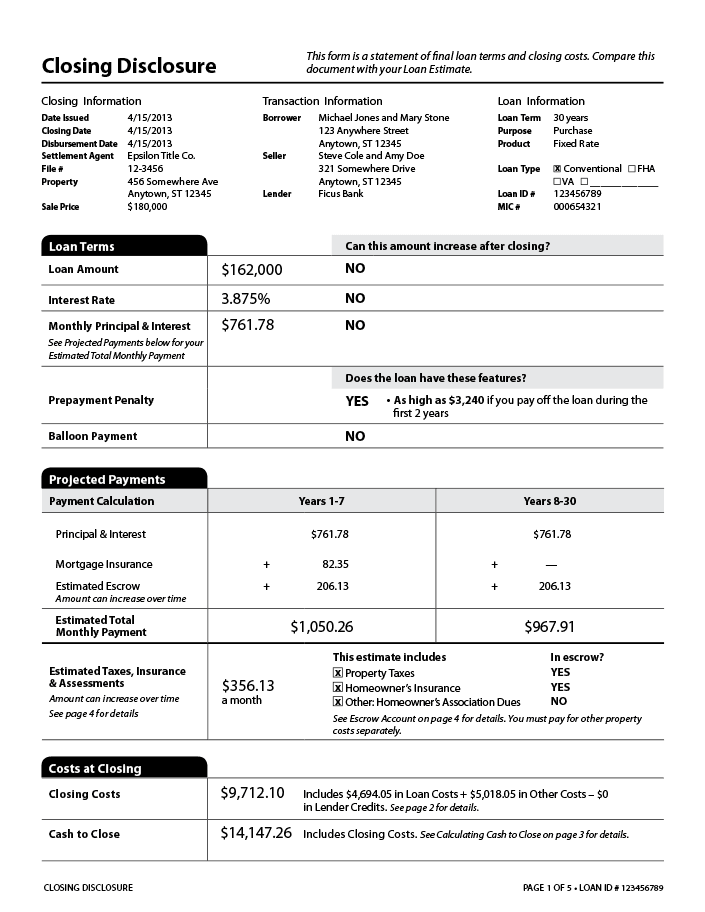

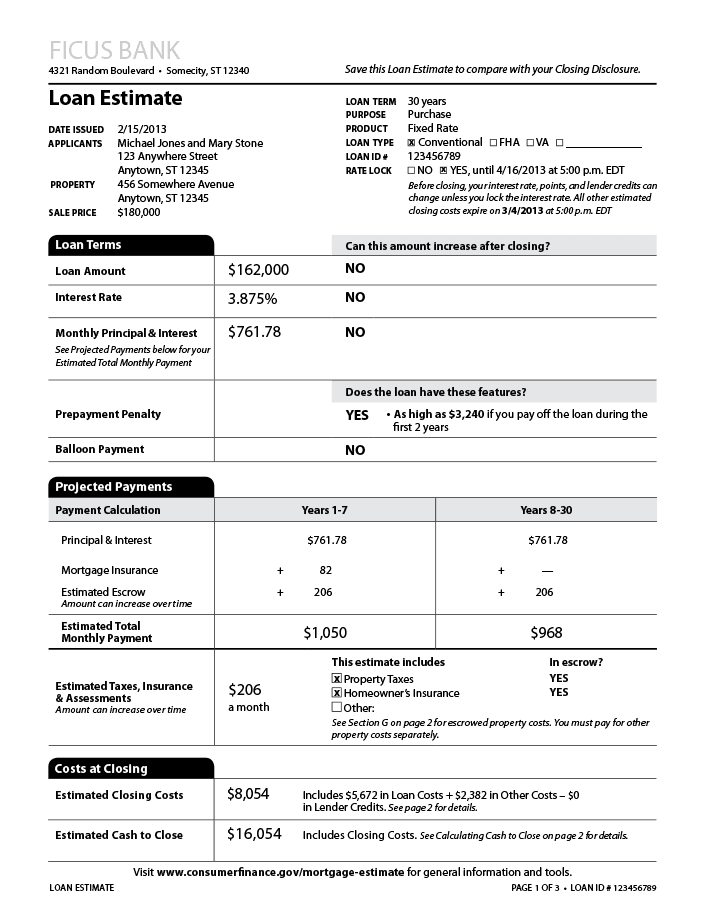

Closing Disclosure Explainer Consumer Financial Protection Bureau

Credit Basics Open Vs Closed Ended Credit Open Ended Credit Is Ongoing You Borrow You Repay You Borrow Again As Long As You Do Not Exceed Your Credit Ppt Download

Loan Estimate Explainer Consumer Financial Protection Bureau